A Roth IRA: In a very Roth IRA, you add funds right after-tax to the account after which appreciate any gains over a tax-cost-free basis. Any gains that occur out soon after age 59 one/two are tax-absolutely free, and you can withdraw your contributions Anytime tax- and penalty-free.

It's also essential to consider your goals for this investment. Will you be in search of extended-time period development, or are you presently aiming for short-phrase security from fluctuating marketplaces? This will not only effects your selection on just how much you will be planning to commit, but exactly where and Whatever you're investing in at the same time.

A traditional IRA: In a traditional IRA, you lead money tax-no cost in the account and after that appreciate any gains with a tax-deferred foundation.

Aquiring a tiny proportion within your portfolio in gold will supply some protection against economic uncertainty and hyperinflation. The rest of your portfolio need to go into investments with extra expected growth possible like stocks or with extra balance, like bonds.

Protect Gold has set up by itself as being a standout for investors who benefit both equally merchandise assortment and personal service. The company offers an in depth collection of gold, silver, platinum, and palladium for IRA inclusion, desirable to those that desire a perfectly-diversified portfolio.

Goldco lets you acquire gold and silver straight, offering adaptability in the event you don’t want an IRA account. Their assortment contains certified gold and silver bars and coins.

Gold IRAs will generally appeal to more experienced investors because they are typically more elaborate and reap the benefits of prior understanding of retirement investing. In addition, given that gold IRAs may well appear with a lot more upfront costs and an absence of a dividend-equivalent payment, investors who can afford additional from the upfront expenditures And do not economically require a consistent flow of income will very likely manage to acquire larger advantage of this sort of IRA.

The service fees on gold IRAs could be reasonably higher when compared with Individuals at the most effective brokers for IRAs. Typically, you’ll really need address to spend several fees for a gold IRA:

Our prime select for getting easy over here to use, Monarch's budgeting application will help you track your expenses and net worthy of. Get fifty% off your first yr with code MONARCHVIP

Irrespective of whether you are commencing smaller or running a considerable portfolio, this yr's major companies provide secure, clear, and supportive paths to investing in precious metals.

Licensing and Partnerships: They ensure which the company retains all necessary licenses and collaborates with a reliable gold IRA custodian.

Augusta Precious Metals provides fees that are aligned with the majority of the rest of the sector, but just one important put the place it sticks out is its significant minimums. The account minimum and minimum purchase are $fifty,000 — very well over a 12 months or two’s annual contribution — indicating you’ll likely need to transfer or roll in excess of an IRA to begin.

Although not all Gold IRA companies are established equivalent. We’ve determined three of by far the most trusted and reputable firms that can help you make the swap — and fortify your money long term prior to the subsequent shockwave hits.

You primarily possess a situation that you trade into and outside of determined by extraneous variables, which may or may not have an impact on the underlying cost. When it will come time for you to provide, take a range. Meanwhile, large hedge cash as well as the like are outside of the marketplace in nanoseconds as well as their result in the marketplace can be devastating.

Jennifer Grey Then & Now!

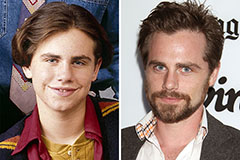

Jennifer Grey Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!